An Honest REALTOR® Take: Why Falling Interest Rates Aren't Going To Help

I know, a REALTOR® saying lower rates are not going to help the Calgary Real Estate Market, 🤯.

But let me explain.

If you don't know me or haven't checked out any of my content before, welcome! I hope you find great value in the discussion below. You can always join our private newsletter or reach out to me at any time by clicking here.

Okay, let's get into it.

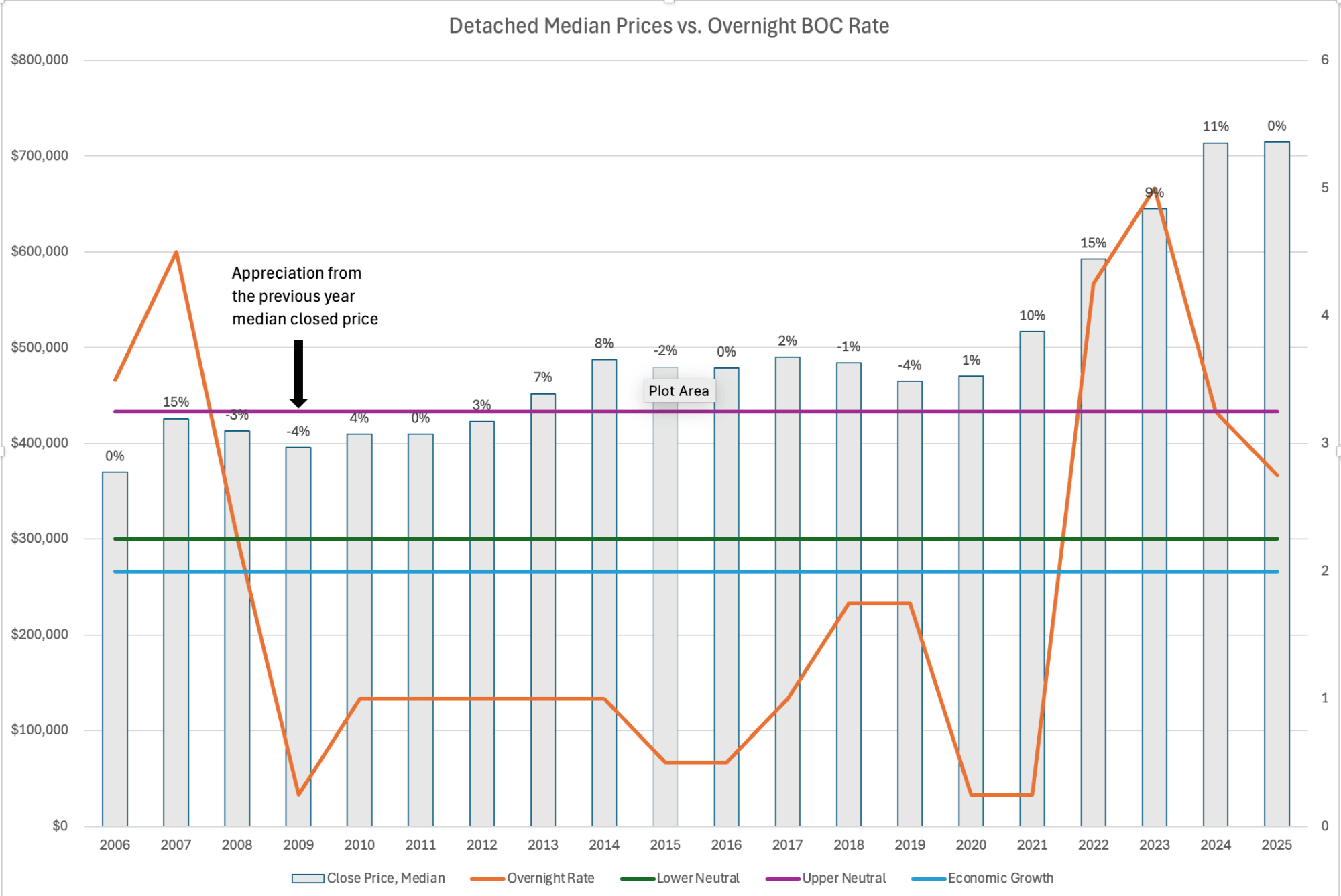

Here is a comparison of the historical median sale prices for detached homes dating back to 2006 (that's as far back as the MLS would let me go) and the Bank of Canada (BOC) overnight rate for just as long.

The chart looks at the median closed prices for single-family detached homes in Calgary since 2006 and compares the BOC's overnight rate for the same time period. The purple and green lines indicate the "neutral zone" for the overnight rate, and the blue line shows the rate at which the BOC feels the rate will impact economic factors in Canada.

When you look at this graph, what do you see?

I see a lower rate from 2008 to 2021 that is well below the BOC's neutral zone, but I also see little to no appreciation for the median prices during this same time.

The theory is that if the BOC reduces their rate, this should increase the purchasing power of buyers by lowering their cost of borrowing, thus enticing them to purchase a property.

In the detached market, which is affordable during this time and is why I have singled out this segment, we didn't see that after the crash in 2008-2009 or the dip in 2015-2016, and it was a very delayed response to the years of early COVID (2020 - 2022).

The values I have over each bar show the appreciation from the previous year, from 2007 onwards. From 2008 to 2021, the median prices in Calgary for detached homes saw next to no appreciation.

It took an extraordinary circumstance of COVID and an advertisement in Ontario and Quebec from our Alberta government to entice those in other provinces to spark the significant increase in our median price in 2022.

But all of this historical information is in the past; our city has grown. Our city, along with Edmonton, saw the most utilization of the federal government housing accelerator program, and the development was pushing hard throughout its inception in March 2023.

But you see what happened in 2024, right?

The interest rates started to drop, and our appreciation year over year slowed to a crawl once again in 2024, to where we are today.

The advertising campaign has stopped. Immigration has slowed to next to nothing, and we have a significant increase in supply to the point that builders are reaching out to realtors to find business.

When just two years ago, we had to fight to remain a part of the purchases our clients were making with builders.

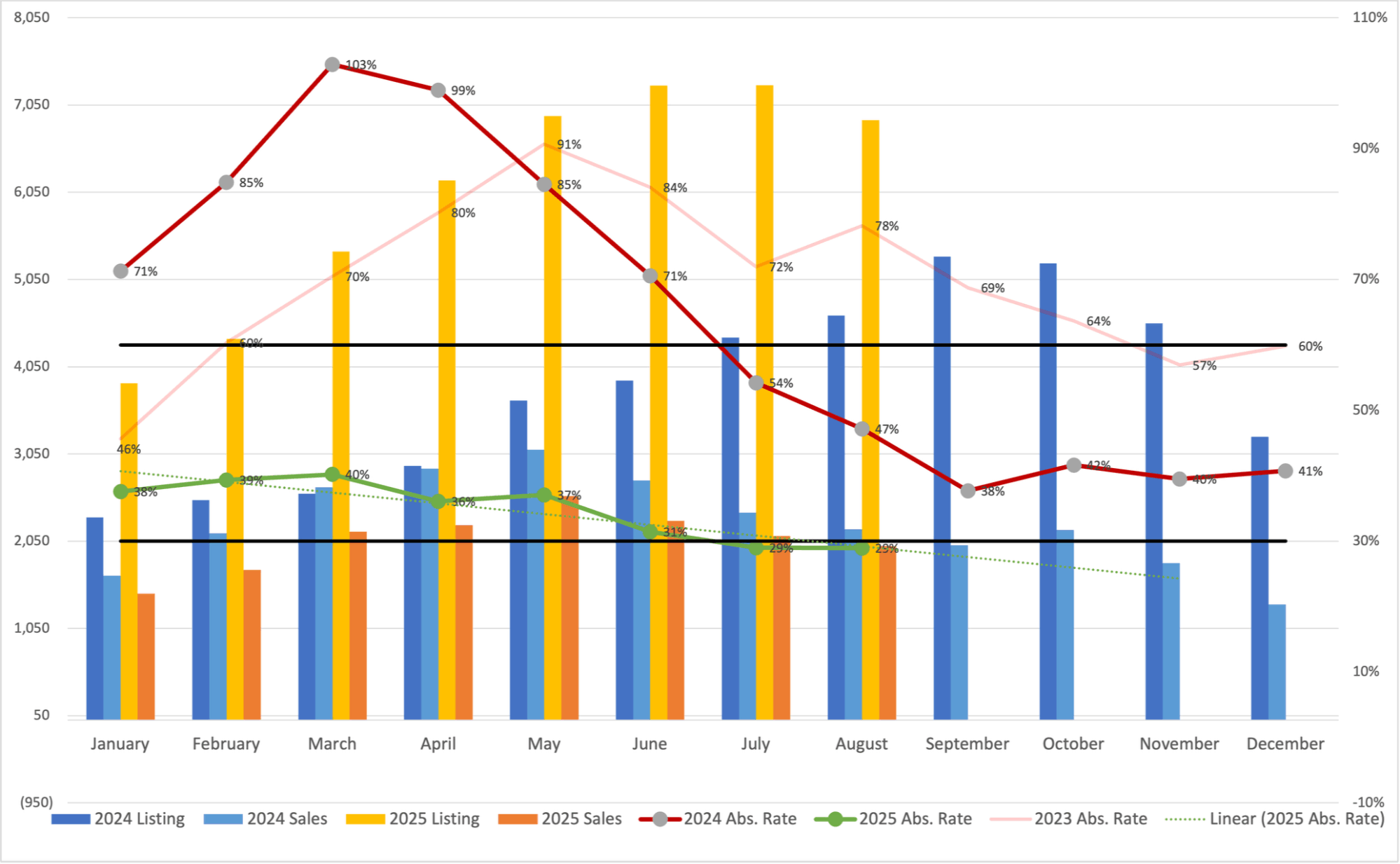

Here is how our activity this year has been going. This chart is part of my private newsletter, and if you'd like to receive it each month, jump on our newsletter by clicking here.

The green line is how we have been trending this year in activity compared to 2024 (red) and 2023 (pink).

The green line is how we have been trending this year in activity compared to 2024 (red) and 2023 (pink).

We are not doing too hot at the moment.

And this trend has been happening since the peak of the market in March 2024. The beginning of this drop is due to the summer months. However, when the first rate dropped in June 2024, we saw our market plunge into a balanced market (between the two black lines), and it has not recovered since.

For our median prices to start to appreciate once again, our activity (absorption rate) needs to be well over 60%. We are currently at 29%.

So, will a drop in interest rates next week move the needle in our Calgary real estate market?

No.

Could it?

Yes, but not in the way we are hoping for our home prices.

If you are looking to purchase a property in Calgary and you'd like to leverage my expertise to have a conversation, please know it would be my pleasure. You can book a time with me by clicking here for a call or an in-person meeting.

If you appreciate this info and would like to join our ecosystem of information, please feel free to click here and join a network of over 1,500 subscribers. We'd love to have you.

Please feel free to share this with a friend.

Aly

Recent Posts

GET MORE INFORMATION